Introduction: Understanding the Power of Compound Interest

Did you know that Warren Buffett, one of the richest people in the world, credits much of his fortune to the power of compound interest? Buffett began investing at the age of 11, and his wealth didn’t skyrocket overnight — it grew steadily over decades, thanks to the magic of compounding. His story is a testament to how small, consistent investments can transform into unimaginable wealth over time.

The power of compound interest is a game-changer when it comes to building wealth. It’s not just about saving money — it’s about growing your money exponentially over time. If you want to get rich over time, mastering compound interest is crucial.

Albert Einstein once called compound interest the “eighth wonder of the world.” Why? Because it has the magical ability to turn small, consistent investments into massive wealth. Whether you’re saving for retirement, a dream home, or financial freedom, compound interest is the key to achieving your goals.

In this blog, we’ll dive into what compound interest is, how it works, and how you can leverage its power to get rich over time.

What is Compound Interest?

Compound interest is the process where the interest you earn on your investment starts earning interest itself. Unlike simple interest — where you only earn interest on your principal amount — compound interest lets your interest grow on both the principal and the accumulated interest.

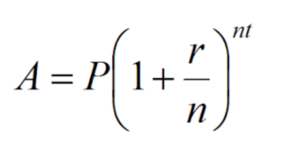

Formula for Compound Interest:

Compound interest is the process where the interest you earn on your investment starts earning interest itself. Unlike simple interest — where you only earn interest on your principal amount — compound interest lets your interest grow on both the principal and the accumulated interest.

Formula for Compound Interest:

Where:

A = Future value of the investment

P = Principal amount (initial investment)

r = Annual interest rate (in decimal form)

n = Number of times interest is compounded per year

t = Number of years

Let’s break it down with a simple example.

If you invest $1,000 at an annual interest rate of 8%, compounded annually, here’s how your money will grow:

After 1 year: $1,080

After 5 years: $1,469

After 10 years: $2,159

After 20 years: $4,661

The key takeaway? The longer you let your money sit, the more it grows — not linearly, but exponentially.

Why is Compound Interest Powerful?

The true power of compound interest lies in time. The longer your money is invested, the more time it has to grow. Even small contributions, if invested consistently over time, can grow into a fortune.

The Snowball Effect

Think of compound interest like rolling a small snowball down a hill. At first, it’s tiny. But as it rolls, it gathers more snow, growing bigger and faster. The longer it rolls, the larger it becomes.

That’s exactly how compound interest works with money. Your initial investment earns interest, then that interest earns interest, and the cycle repeats — a snowball effect for your wealth.

How to Maximize the Power of Compound Interest

If you want to get rich over time, here are the key strategies to harness the power of compound interest:

1. Start Early

The earlier you start investing, the more time your money has to compound. Let’s look at two scenarios:

John starts investing $200/month at age 25 and stops at 35. His money compounds until retirement at 65.

Emma starts investing $200/month at age 35 and continues until 65.

Even though John only invested for 10 years and Emma for 30, John ends up with more money at retirement, thanks to the extra 10 years his money had to grow. Starting early gives your money time to work its magic.

2. Invest Consistently

Consistency is key. Make regular contributions to your investments — whether it’s monthly, quarterly, or yearly. Automate your investments to stay disciplined, ensuring your money compounds without interruption.

3. Reinvest Earnings

Reinvest any interest, dividends, or gains you earn. Instead of cashing out, let your earnings roll back into your investments. This allows compound interest to work at full power.

4. Increase Your Contributions Over Time

As your income grows, boost the amount you invest. If you start with $100 a month, aim to increase it to $150, $200, and so on. Increasing your investments means more principal for compound interest to work with.

5. Choose High-Interest Investments

Seek investments with favorable interest rates and compounding periods. Consider stocks, mutual funds, or high-yield savings accounts. The higher the interest rate and the more frequently it compounds (monthly, quarterly), the faster your money will grow.

Compound Interest vs. Simple Interest

Let’s compare compound interest and simple interest.

| Feature | Compound Interest | Simple Interest |

|---|---|---|

| Interest Growth | Grows on principal and interest | Grows only on principal |

| Returns Over Time | Exponential | Linear |

| Wealth Potential | Higher over time | Lower compared to compounding |

The power of compound interest clearly outweighs simple interest when it comes to long-term wealth building.

Real-Life Examples of Compound Interest

1. Warren Buffett’s Fortune

Warren Buffett, one of the richest people in the world, credits much of his wealth to compound interest. He started investing at age 11 and let his money grow for decades. His fortune wasn’t built overnight — it’s the result of years of compounding.

2. Retirement Savings

If you invest $500 a month starting at age 25, with an average 8% return, you’ll have over $1 million by the time you’re 65. Start at 35, and you’d have only about $500,000. Time is money — quite literally.

Tools to Calculate Compound Interest

Use online tools to visualize how compound interest can grow your money:

Compound Interest Calculator by Investor.gov (nofollow)

Bankrate Compound Interest Calculator (nofollow)

Conclusion

The power of compound interest is the secret ingredient to building lasting wealth. By starting early, investing consistently, and letting your money grow, you can get rich over time. Don’t wait — put compound interest to work for you today!

Remember: The longer you let compound interest work, the more money you’ll have in the future. Start small, stay consistent, and watch your wealth snowball.

OreraQEd fbc SJn

I am truly thankful to the owner of this web site who has shared this fantastic piece of writing at at this place.

Great information shared.. really enjoyed reading this post thank you author for sharing this post .. appreciated

There is definately a lot to find out about this subject. I like all the points you made

I just like the helpful information you provide in your articles

I really like reading through a post that can make men and women think. Also, thank you for allowing me to comment!